Love it or hate it, while you live in Japan, you’ll have to pay residence tax. Whether you are a long-term resident, a temporary expat, or just planning to move to Japan, this guide will equip you with the knowledge and tools needed to manage your residence tax obligations.

Understanding Residence Tax

Residence tax in Japan, known as “juuminzei” (住民税), is a unique local tax that distinguishes itself from other forms of taxation. Unlike national taxes such as income tax or consumption tax, residence tax is collected by local municipalities, making it a fundamental source of revenue for local governments. This tax is primarily based on an individual’s or household’s status as a resident within a specific municipality.

Determining who is obligated to pay residence tax hinges on the concept of tax residency. In Japan, you are considered a tax resident if you meet one of the following criteria. First, if you have a registered abode in Japan, you are a tax resident of the municipality where that’s located. Second, if you do not have a registered abode but have been living in a municipality for more than a year, you are also considered a tax resident of that municipality.

These criteria apply to both Japanese nationals and foreigners alike, meaning that expats living in Japan for an extended period are typically subject to residence tax obligations in their respective municipalities.

Different Kinds of Residence Tax

Residence tax in Japan is further categorized into two main components: prefectural tax (known as “kenminzei”) and municipal tax (known as “shiminzei”). These two components serve distinct purposes within the local tax system.

Prefectural tax, or “kenminzei,” is collected by prefectural governments and is used to fund a range of regional services and projects. These services often include infrastructure development, regional healthcare programs, and educational initiatives that benefit residents on a broader scale. For example, prefectural tax contributions may go towards improving transportation networks, building, and maintaining public facilities, and supporting local industries, all of which contribute to the overall well-being of residents within a specific prefecture.

On the other hand, municipal tax, or “shiminzei,” is collected by individual municipalities and is primarily allocated to finance local services and amenities. These can encompass essential services such as garbage collection, fire and police departments, local schools, parks, and cultural facilities. Residence tax also plays a pivotal role in supporting community events and initiatives that foster a strong sense of belonging and cultural identity among residents.

Calculating Residence Tax

Calculating residence tax in Japan is a multi-step process influenced by various factors that determine the final tax amount. The primary factors include an individual’s or household’s income, their municipality of residence, and the applicable tax rates set by local authorities.

First and foremost, an individual’s or household’s income is the cornerstone of residence tax calculation. In Japan, the tax authorities typically assess your income from the previous year as the basis for calculating your current year’s residence tax. This income includes various sources, such as employment income, rental income, business income, and capital gains. Deductions and exemptions are applied to arrive at the taxable income figure.

The second crucial factor is the municipality of residence. Different municipalities have varying tax rates and regulations, so the residence tax amount can differ significantly from one location to another. This means that residents need to be aware of the specific tax rules in their municipality and consider them when planning their finances.

To give a rough figure, you’ll be paying about 10% of your income as residence tax.

Payment Schedule

The payment schedule for residence tax in Japan follows a specific timeline and offers instalment options to help residents manage their tax payments effectively.

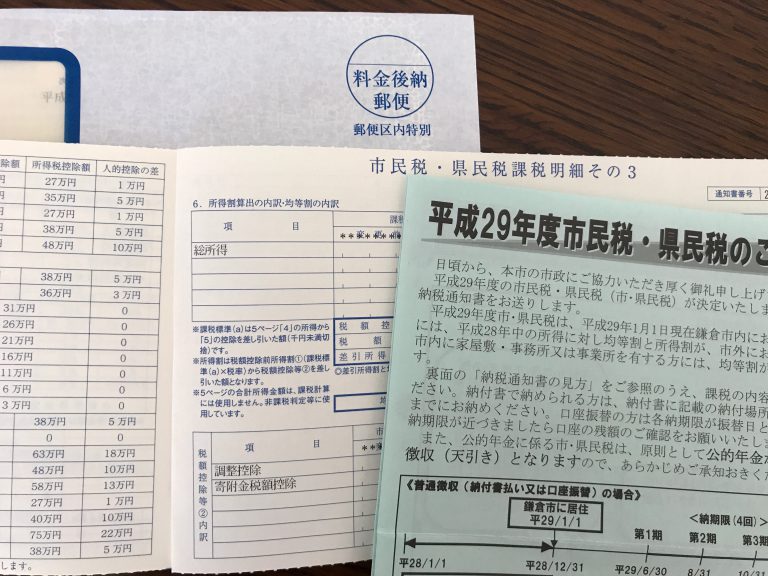

Generally, residence tax is assessed annually based on your income from the previous year. The assessment process typically begins in June and continues through July when local tax authorities send tax assessment notices to residents. These notices outline the amount of residence tax owed and provide payment instructions.

Residents in Japan are usually required to pay their residence tax in two instalments. The first instalment, typically around 60% of the total tax amount, is due by the end of August. The second instalment, representing the remaining 40%, is typically due by the end of January in the following year.

I pay my tax bills at the post office, which I have to get to before 4pm on a weekday to catch the right window before it closes. Other options include, electronic payment transfers, or even paying at a combini.

To manage tax payments and avoid penalties for late payments, here are some essential tips:

- Plan Ahead: As soon as you receive your tax assessment notice, review it carefully and set aside the funds needed to cover your tax obligation. Knowing the due dates in advance allows for better financial planning.

- Consider Auto-Pay: Some municipalities offer automatic bank withdrawal options for residence tax payments. Enrolling in this service can help ensure that you never miss a payment deadline.

- Mark Due Dates: Make note of the due dates on your calendar or set reminders to avoid forgetting them. Missing payment deadlines can lead to penalties and interest charges.

- Budget Wisely: Plan your budget to accommodate your tax payments comfortably. By setting aside money regularly, you can avoid financial stress when the tax bills come due. We all know someone who thought they were a baller, right up until the fateful day their tax bills came through.

- Communicate with Tax Authorities: In case you anticipate difficulty in meeting your tax obligations, it’s advisable to contact your local tax office in advance. They may be able to arrange a payment plan or provide guidance on available options. Get ready for an absolute wall of Japanese to have to climb, so I’d advise taking a fluent friend if you aren’t proficient.

Exemptions and Deductions

Foreigners residing in Japan may be eligible for certain exemptions and deductions when it comes to residence tax. These provisions can help reduce the overall tax burden, provided specific eligibility criteria are met.

- Dependent Deduction: Foreign residents who financially support family members living abroad may be eligible for a dependent deduction. This can apply to spouses, children, or other dependents, and the amount deducted depends on the number and circumstances of the dependents.

- Special Exemption for Foreign Researchers and Teachers: Foreign researchers, educators, and their dependents may qualify for a special exemption on their residence tax. This exemption aims to attract and retain talent in academic and research fields.

- Spouse Deduction: Married individuals may be eligible for a spouse deduction if their spouse has little or no income. This deduction can help reduce the tax liability for couples.

- Disability Deduction: Individuals with disabilities or their caregivers may be eligible for deductions based on the degree of disability and care required.

- Senior Citizen Deduction: Elderly residents may qualify for a senior citizen deduction based on their age and income level. This deduction is designed to provide financial relief for retirees.

Non-Compliance

Non-compliance with residence tax regulations in Japan can have serious consequences, making it imperative for residents, including foreigners, to stay informed and fulfil their tax obligations diligently. Failure to do so can lead to a range of legal and financial issues.

One significant consequence of non-compliance is the imposition of penalties and fines by tax authorities. Late or incorrect payments, as well as failure to report changes in income or residency status, can result in monetary penalties. These fines can accumulate over time and significantly increase the overall tax burden, potentially causing financial strain.

Moreover, non-compliance with residence tax regulations may lead to legal repercussions, including legal actions and disputes with tax authorities. In extreme cases, individuals who consistently neglect their tax obligations may face more severe consequences, such as tax evasion charges, which can result in criminal penalties and damage to their legal and financial standing.

Therefore, it is essential for all residents, including foreigners, to prioritize staying informed about Japanese tax regulations, fulfilling their tax obligations accurately and promptly, and reporting any changes in their circumstances to the tax authorities.