The pension system in Japan is an essential part of the social security net that ensures a basic level of retirement income for all citizens. The system is divided into two parts: the public pension system, which covers all employees and self-employed individuals, and the employer-based retirement plans, which are optional and provided by companies.

The public pension system is based on a pay-as-you-go system, where the current working generation pays for the pension benefits of the current retirees. This system is supplemented by employer-based retirement plans that offer additional benefits to employees. In this article, we will explore the details of how the pension system works in Japan, the eligibility criteria, the payment options available, and the tax implications of receiving pension payments.

Public Pension System

The public pension plan in Japan is a mandatory retirement plan that covers all employees and self-employed individuals. The plan is made up of three parts: the National Pension (for self-employed individuals and those not eligible for the Employees’ Pension Insurance system), the Employees’ Pension Insurance system (for company employees), and the Mutual Aid Pension (for certain professions and industries who can’t access other pensions, run by Mutual Aid Associations (MAAs)). To be eligible for pension benefits, individuals must have made contributions to the plan for at least 10 years.

There are two types of public pension plans available to employees: the defined benefit plan and the defined contribution plan.

- The defined benefit plan guarantees a certain amount of retirement income based on the employee’s length of service and salary history.

- The defined contribution plan, on the other hand, is dependent on the investment performance of the employee’s account. The amount of pension pay-out depends on the number of years of contributions, the average salary during that period, and the age at which the recipient starts receiving the pension.

As of 2023, the maximum pension payment is ¥780,000 per year, and the average pay-out is around ¥270,000 per year. However, the actual amount of pay-out can vary depending on the individual’s contribution history and the timing of their retirement.

Employer-Based Retirement

Employer-based retirement plans in Japan are optional plans provided by companies to their employees. These plans are intended to supplement the public pension plan and offer additional benefits to employees. Companies can choose from two types of retirement plans: defined benefit plans and defined contribution plans. In defined benefit plans, the employer guarantees a certain amount of retirement income based on the employee’s salary and years of service. Defined contribution plans are dependent on the investment performance of the employee’s account. The type of plan offered by a company can vary depending on the industry and the size of the company.

Eligibility for employer-based retirement plans can also vary depending on the company. Some companies may require employees to work for a certain number of years before becoming eligible to participate in the plan. Pay-outs from employer-based retirement plans can be in the form of a lump-sum payment or as ongoing pension payments. The amount of pay-out depends on the type of plan, the length of service, and the employee’s salary. Some companies may also offer additional benefits, such as healthcare and life insurance, as part of their retirement plans.

It’s important for employees to carefully review the terms and conditions of their company’s retirement plan and to seek professional advice if needed.

Many famous companies in Japan offer employer-based retirement plans to their employees. For example, Toyota, one of the largest automakers in the world, offers a defined benefit retirement plan to its employees. The plan is based on years of service and provides a guaranteed amount of retirement income. Employees are eligible to participate in the plan after five years of service. Toyota also offers a defined contribution plan, in which the employer matches the employee’s contributions up to a certain percentage.

Another example is Sony, a leading electronics and entertainment company. Sony offers a defined contribution retirement plan to its employees, in which the employer matches the employee’s contributions up to a certain percentage. The plan is based on individual investment performance, and employees have the flexibility to choose their own investment options. Sony also offers additional benefits, such as healthcare and life insurance, as part of its retirement plan package.

JET Programme

The JET Programme is a popular route for many people to get into Japan. All JET Programme participants are eligible for a retirement plan provided by the Japanese government. JETs are enrolled in the National Pension plan, which is a mandatory retirement plan for all residents in Japan, regardless of their nationality. However, they are not eligible to join the Employees’ Pension Insurance system, which is only available to Japanese citizens and permanent residents.

The National Pension plan for JET Programme participants is a defined contribution plan, meaning that the amount of pay-out depends on the amount of contributions made by the participant during their period of enrolment. The plan requires participants to contribute a fixed amount of money each month, which is calculated based on their income. The minimum contribution is ¥16,400 per month, and the maximum contribution is ¥66,000 per month, as of 2023. The amount of pension pay-out depends on the total amount of contributions made, the investment performance of the participant’s account, and the age at which they start receiving the pension.

JET Programme participants can also choose to participate in a voluntary retirement savings plan provided by their contracting organization. This plan is typically a defined contribution plan, in which the employer matches the employee’s contributions up to a certain percentage. The terms and conditions of the retirement savings plan can vary depending on the contracting organization, and it’s important for participants to carefully review the details of the plan before enrolling. Overall, while the retirement plan available for JET Programme participants may not be as comprehensive as the plans available to Japanese citizens and permanent residents, it still provides an important source of retirement income for these foreign workers in Japan.

Most people I know just treat their pension contributions as forced savings whilst they’re on the programme and intend to invest the money they’ve saved in a retirement fund in their home country when they leave. It’s not a wallet-breaking amount of money to pay each month, so you shouldn’t be worried about it.

Getting the money back

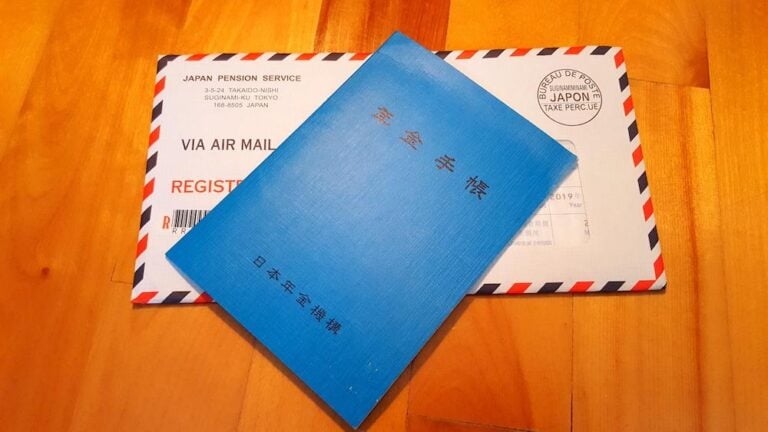

Foreign nationals who have been paying Pension Insurance, and who give up residence in Japan, can apply for a Lump-sum Withdrawal Payment, also known as “dattai ichijikin”.

To be eligible for the refund:

- An application must be submitted within two years of leaving Japan.

- The applicant must not possess Japanese citizenship.

- The applicant must have paid premiums for six months or more.

- The applicant must not have a place of residence in Japan.

- The applicant must never have qualified for pension benefits.

JETs have two options when they leave the country, they can either receive a lump-sum payment (for those who have paid in for a maximum of five years), or transfer the total number of years paid into the Japanese pension system to the equivalent system in their home country. It should be noted that the UK currently doesn’t have a system in place to facilitate this enrolment. The US, Canada and Australia all do have a system in place though.

To apply for the Lump-sum Withdrawal Payment, the applicant must obtain the form “Lump-sum Withdrawal Payment Arbitration Bill” before leaving Japan and fill it in with all necessary information. The completed forms and accompanying documents should then be mailed to the Japan Pension Service. In total, a JET can expect to receive the following approximate amounts based on their period of coverage: 1 year (12 months) ~¥280,000, 2 years (24 months) ~¥560,000, 3 years (36 months) ¥840,000, 4 years (48 months) ~¥1120000, and 5 years (60 months) ~¥1400000. A 20% income tax is imposed on the Lump-sum Withdrawal Payment. But don’t fear, you can claim that back after you’ve left Japan if you ask someone you know to be your tax agent.

Sometimes, understanding the world of pensions can tad confusing. For most foreigners working in Japan, the main point to remember is that you can claim it back when you leave. It might be a bit of a convoluted process, but it’s by no means impossible!