Many expats living in Japan want a credit card for their time here. The security a credit card offers, as well as reward schemes, make it a no-brainer for most people. I have to admit, being from the UK I was content with a debit card for a couple of years of being here. It wasn’t until my friend told me about the 1% reward system that I started to want one.

I applied endlessly and was rejected every time. In this article, I’m going to compound what I learned into a useful guide that should help you get approved first time.

What does this card offer

The main advantage of the Rakuten credit card is its 1% reward system. That is, for every 100 yen you spend, you get 1 Rakuten point (the equivalent of 1 yen) added to your account in the next pay cycle. These points can be used at a variety of stores across Japan including McDonald’s, 7-Eleven, Daimaru, and more! I use most of my points at a Seiyu (supermarket) near my house, or the gas station when I’m fuelling up my bike.

Aside from this consistent reward system, you also accumulate some sign-up bonus points when you first apply for and spend money on the card. This changes periodically, but on average most people are looking at receiving about 7000 yen when signing up.

The card offers a range of payment plans, but most people opt for the single payment taken out on the 27th of every month. You can also do interest-only payment plans and other similar options if you’re in a tight bind, but as we all know, this can be a slippery slope if you aren’t careful.

Unfortunately, whilst you’ll be building credit in Japan, credit scores don’t transfer between countries. So, you can’t expect to see your score at home improve by using the Rakuten card.

How to apply

I got rejected so many times because of the fact that my bank account has my name in katakana and omits my middle name, whereas my residence card has my name in the alphabet, including my middle name. Officially, this meant my ID and account information didn’t match, so I was rejected constantly. As a word of advice when applying for the card, make sure to be meticulous when you enter in your names at all points, ensuring that things like if you include your middle name are thought out.

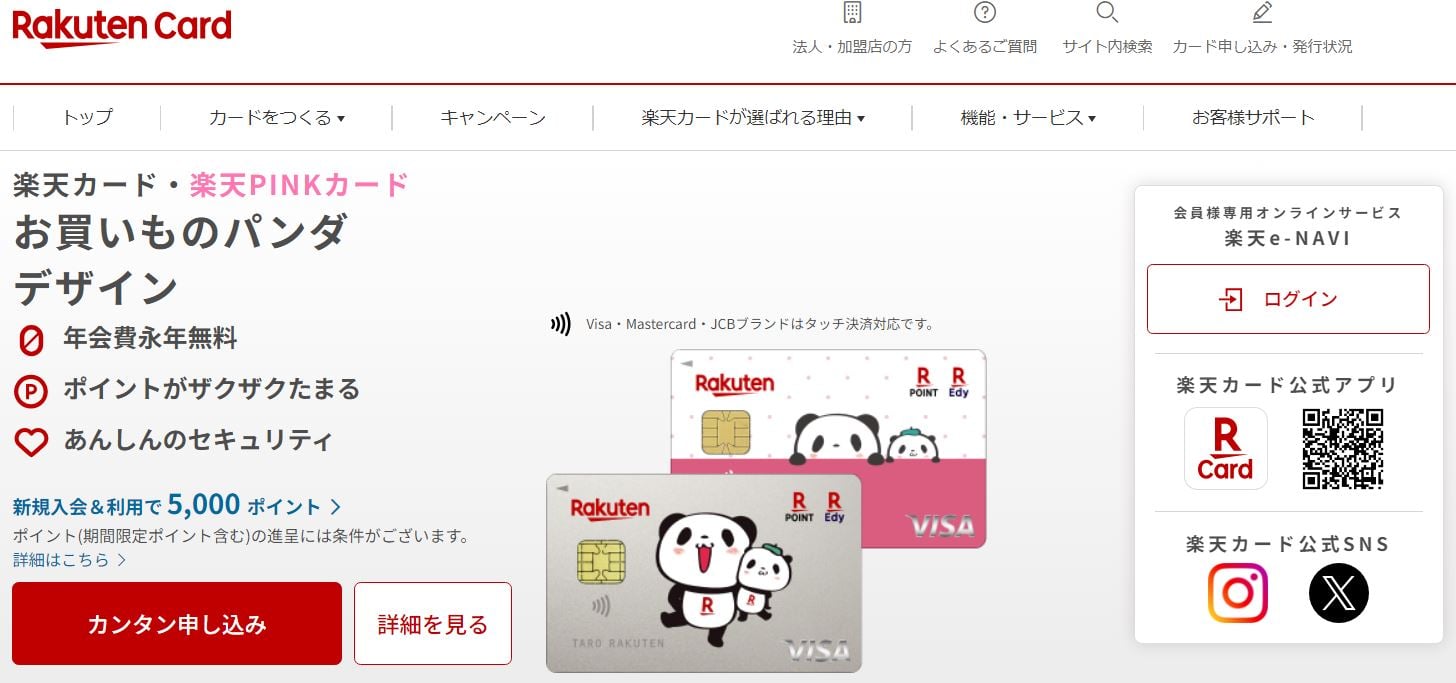

Step 1:

Navigate to the Rakuten card website and click on カンタン申し込み (Simple Application).

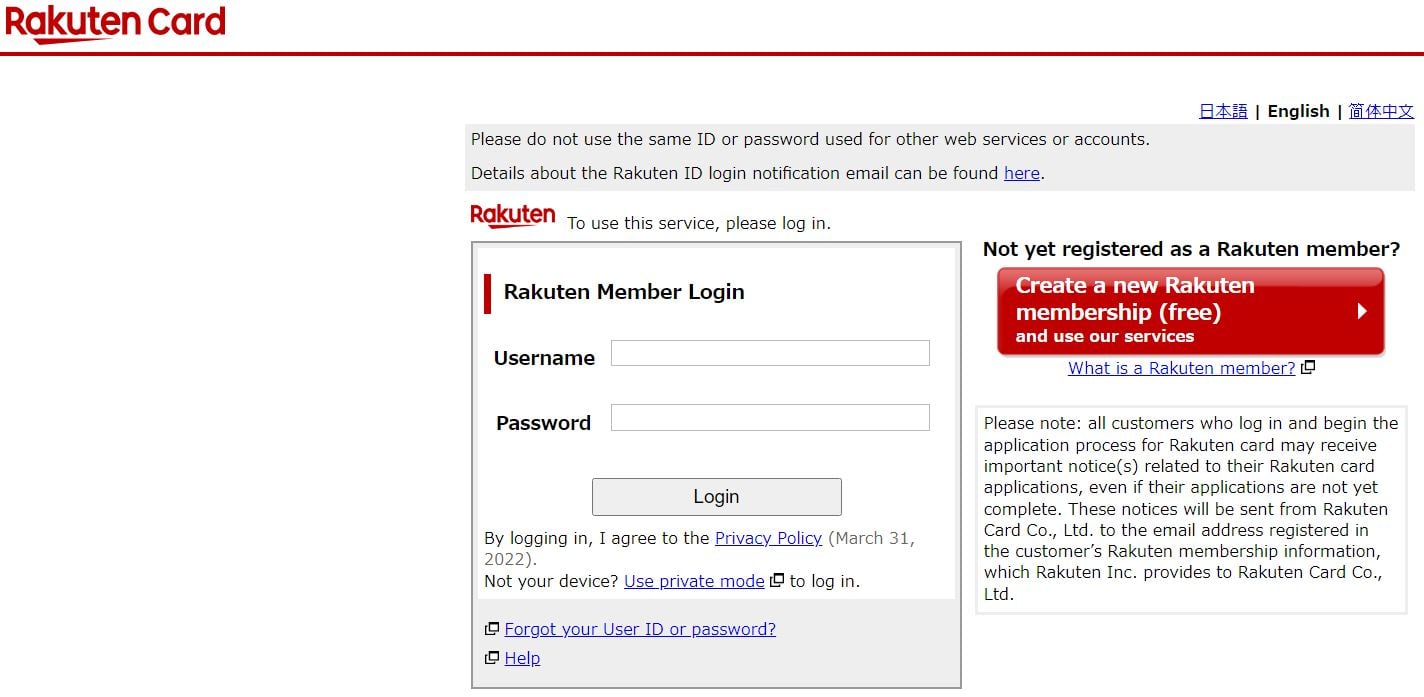

Step 2:

Now, change the language to English to make the process a bit easier for you using the selector on the top right of the screen.

At this point either create a Rakuten account or log in, depending on which applies to you.

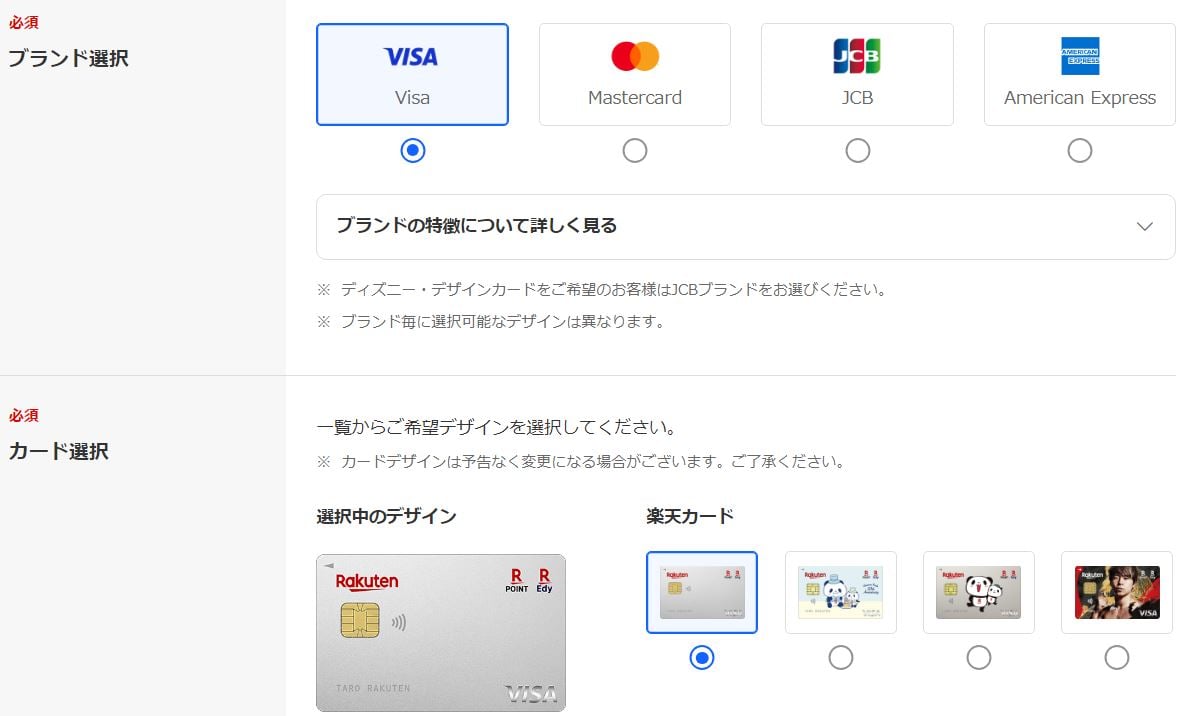

Step 3:

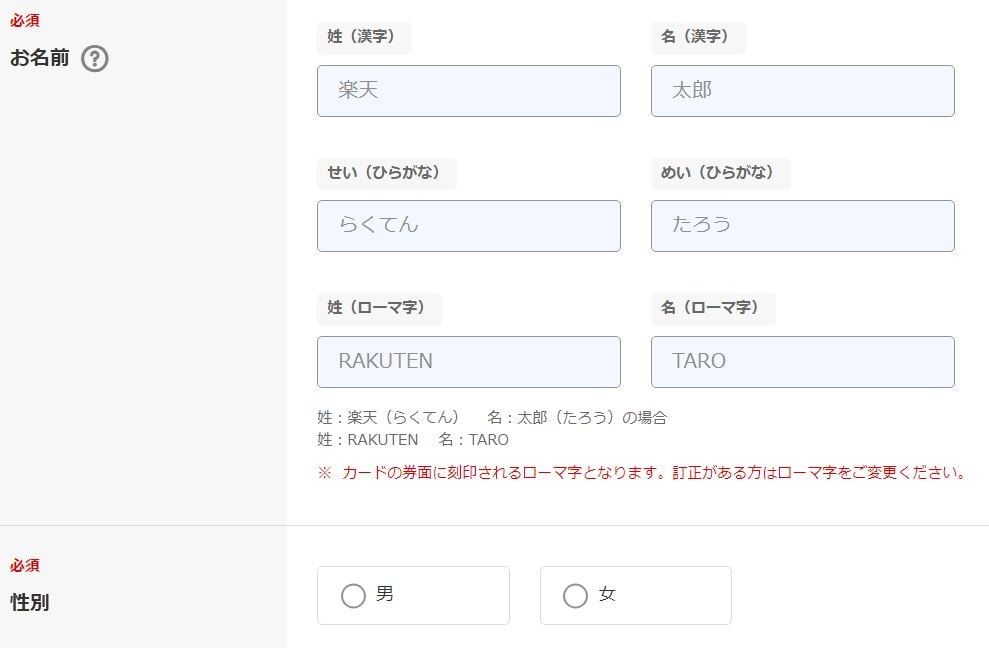

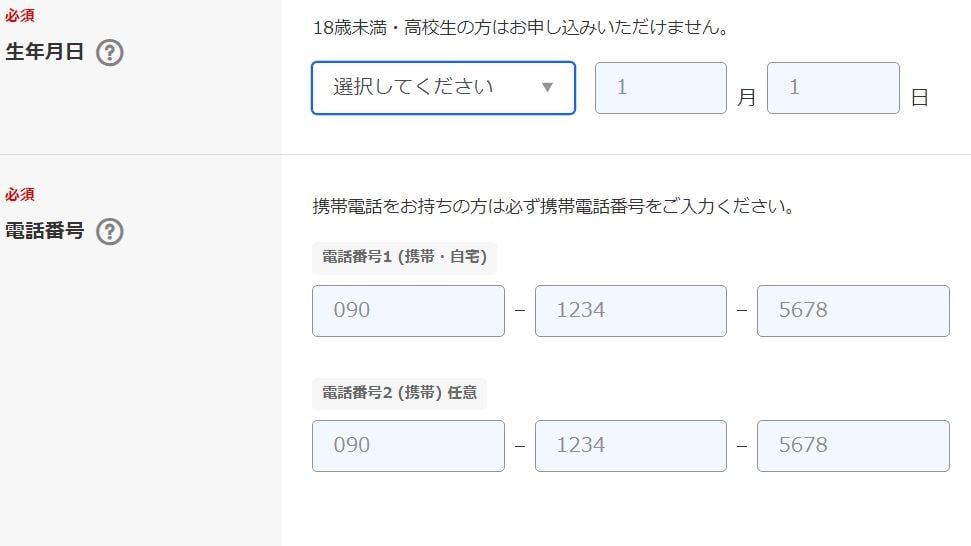

Note: 必須 means essential and is used a lot in this application.

This stage is about choosing what brand of card you would like, and what design you’d like on the card itself.

Step 4:

Fill in your name and gender. 性 (sei) means family name and 名 (mei) means first name. You should put your middle name in the 名 field, with a space separating your first and middle names.

Step 5:

Next, enter your date of birth. Note that it’s in year/month/day order with 月 (tsuki) meaning month and 日 (hi) meaning day. You’ll also need to enter a Japanese phone number in the 3 digit – 4 digit – 4 digit way outlined in the example.

Step 6:

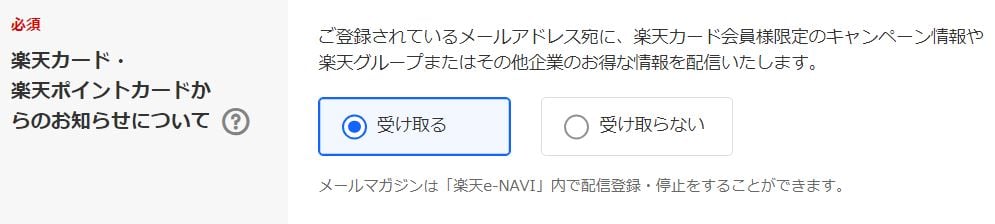

Enter in your email address and then choose whether you’d like to receive notifications from Rakuten about the card. If you would like notifications sent, press the button on the left. If not, choose the button on the right.

Step 7:

Next, enter in your address (ご住所) as it appears on your ID.

Step 8:

For the ご家族について section, they’re asking about your family situation. These are the options in English:

- 配偶者あり子供あり – You have a spouse and children

- 配偶者あり子供なし – You have a spouse but no children

- 配偶者なし子供あり – You don’t have a spouse but do have children

- 独身(家族別居)- You are single and live apart from family

- 独身 (家族同居) – You are single and live with family

Note: You only have a spouse if you are married.

For the 世帯人数(同一生計の人数) section, they’re asking about the number of people in your household. Select the option that applies, including yourself.

The next section is your 居住状況 living situation. To keep this part simple, you’re most likely going to need 借家 renting a house or アパート apartment. You’ll need 寮 if you’re staying in a student residence or dormitory of some kind.

For the 居住年数 section simply select how long you’ve lived in your current residence.

Step 9:

住宅ローンもしくは家賃のお支払い is asking if you, the applicant, pay your own mortgage or rent. Select the option on the left if you do, and the right if you don’t (someone other than you pays your rent)

お勤め先・学校について is about your place of work or education. You’ll need to select one of the following:

- お勤めの方 – People who work

- 学生の方 - Students

- 年金受給の方 - Retirees

お勤めされていないかた – Those without a job

預貯金額 is about the amount of savings you have. Remember that 1万 is 10,000 yen. You’ll have to work out your savings in multiples of 1万.

請求書送付先 is about where your application should be sent to. Select 自宅 for home.

Step 10:

カード入会後のご利用目的(複数回答可)is asking about why are you wanting a credit card. Pick the top option for normal everyday purchases, and the second if you need a cash loan for something.

他社からのお借入金額 is asking about of you owe another company any money. This excludes mortgages. Those who have pick あり and those that haven’t pick なし.

The next part is to sign up for the Rakuten Edy service. This is a prepaid card function that can be applied to the Rakuten credit card so that when you enter stores a transaction can be done at lightning speeds as with IC cards. I personally don’t feel like this is a necessary function as lots of places now accept touch payment with cards in Japan. If you are interested press 希望する and if you aren’t then press 希望しない. The next option is whether you’d like to set up an Auto top-up system for the Edy function. If yes, pick 申し込む and if no pick 申し込まない.

Step 11: This step is most important.

This is the step where you link your bank account to the credit card for payments. My biggest recommendation is to skip the online set-up and opt for the set-up by mail. The reason for this, is that any discrepancies with you name between documents will be easy for a human to notice and accept than the online service. I was rejected constantly until I gave in and did the mail service. Save yourself the trouble and click 郵送でお手続き on the form to do it by paper.

Step 12:

暗証番号 Set up your 4 digit security code for the card.

Step 13:

When the document gets delivered to your house for connecting your bank account, be sure to fill it out promptly.

Step 14:

After some ID confirmation and a little bit of waiting (a few business days) your application should be approved or denied, and notification will be sent to your email address. Then you can get your card and have fun earning all that free money!

There you have it. A clear guide for how to get your Rakuten credit card.