It must be said: banks in Japan are just different. If you’re considering moving to Japan or have already secured a job in Japan, it’s worth taking the time to research how banking is approached here. After all, this will be the institution that determines whether or not you will have access to your hard-earned cash. In this article, I will tell you some of the basic ways to transfer money to another account as well as how to receive money via transfer.

Furikomi means “transfer,” written as 振り込み or 振込. Back in America, on the rare occasions I needed to transfer funds to another account, I knew I could hop onto my online account or use a banking app to send money within a matter of minutes. In Japan, the process is not dissimilar, but there are a few things to keep in mind when attempting to transfer money. Most importantly: you might not be allowed to do it.

That’s right. Your account may not automatically have fund transfer permission. Japanese banks currently straddle the states of piles of stamped documents and the paperless digital banking world that many other countries offer. During this period of growth, it is possible that some functions have moved to the online realm but still require stamped paperwork (with your personal stamp, called hanko or inkan) to be approved. So, while theoretically you will have the ability to send funds, it’s necessary to check on your mobile app or at your local bank branch if your account is set up for it.

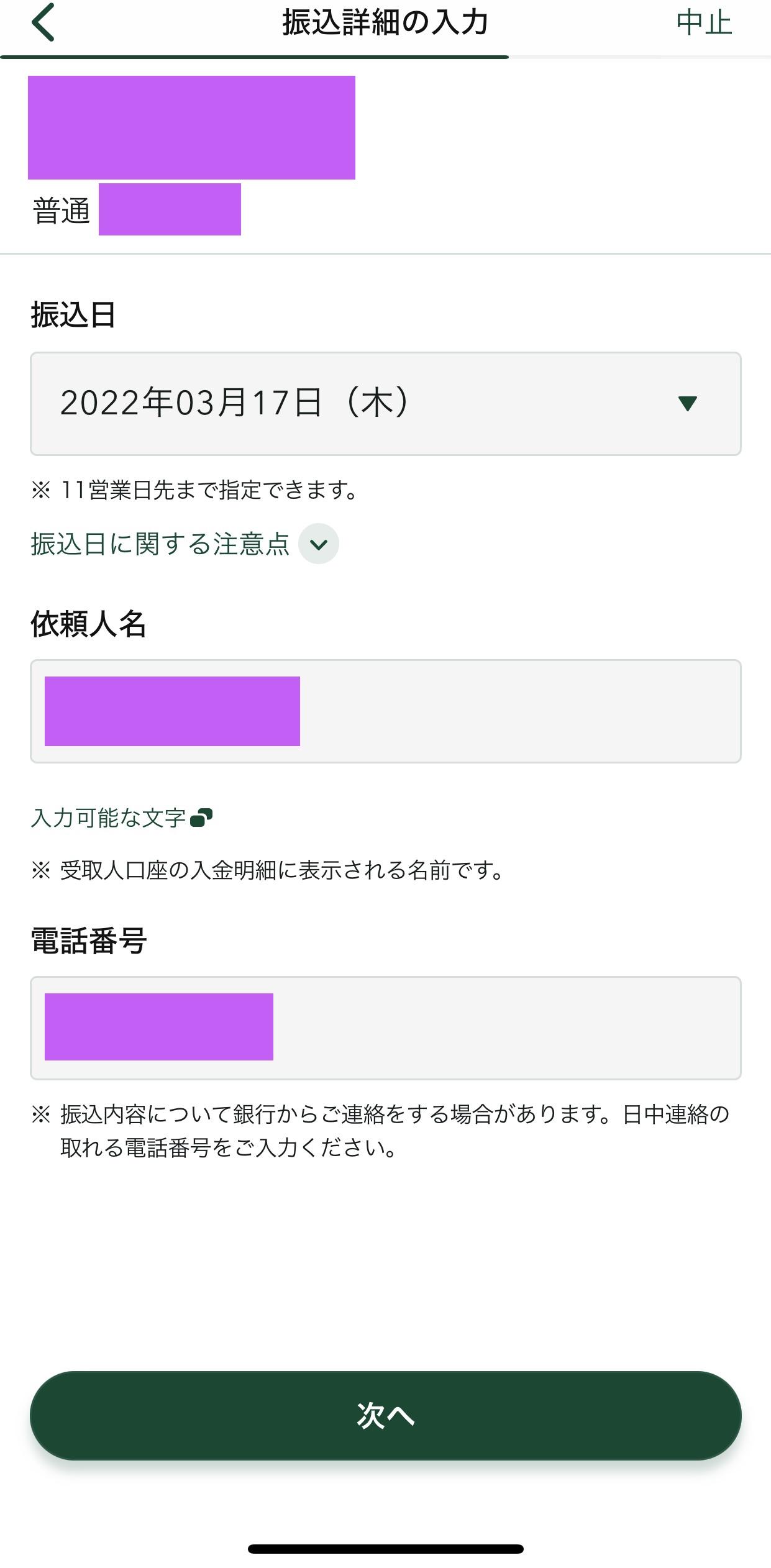

After ensuring that transferring money is possible, it’s time to get down to business. For online banking, many banks are pushing the use of their smartphone apps and it is very likely you will be transferring funds through this method.

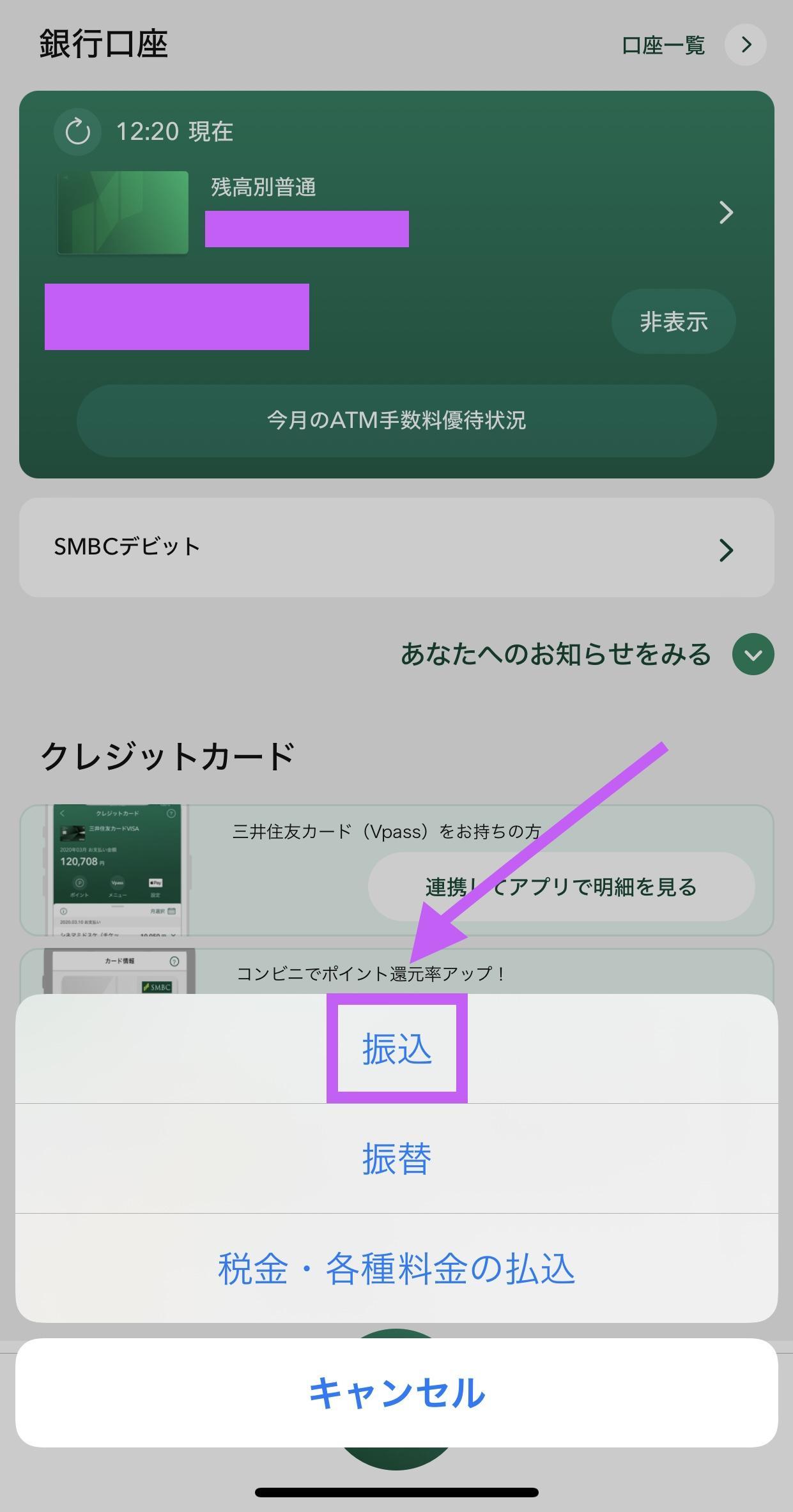

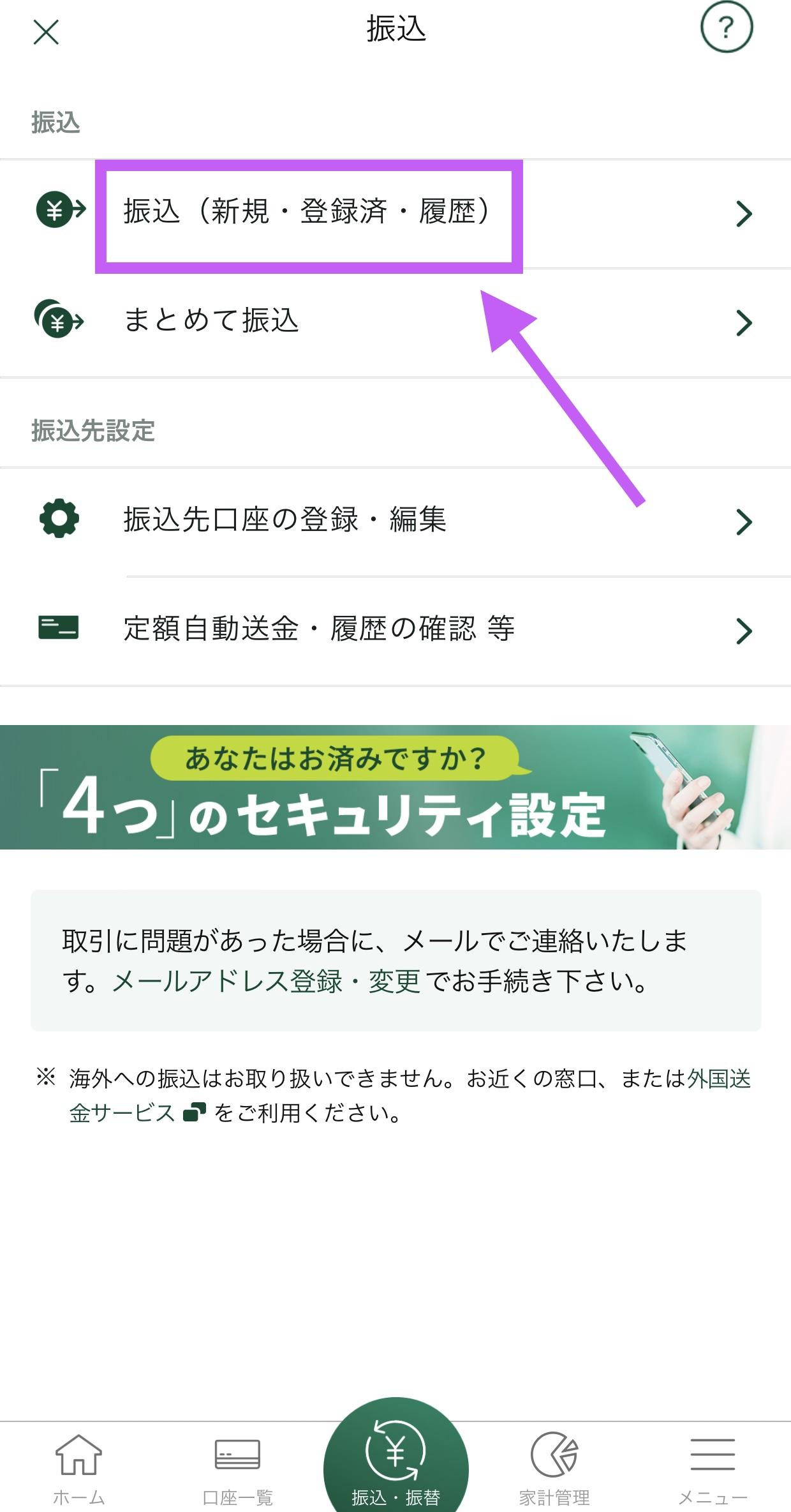

First, log in to your account through the app and click on the “transfer” button. If you do not have permission for this function yet, you will be promptly notified.

Next, you will be lead through a series of questions about your furikomi-saki 振込先, the recipient. You will be prompted to select from a list the name of the bank the recipient belongs to.

Four major banks in Japan are:

- 三井住友銀行 Sumimoto Mitsu (SMBC)

- みずほ銀行 Mizuho

- 三菱UFJ銀行 Mitsubishi UF

- いそな銀行 Risona

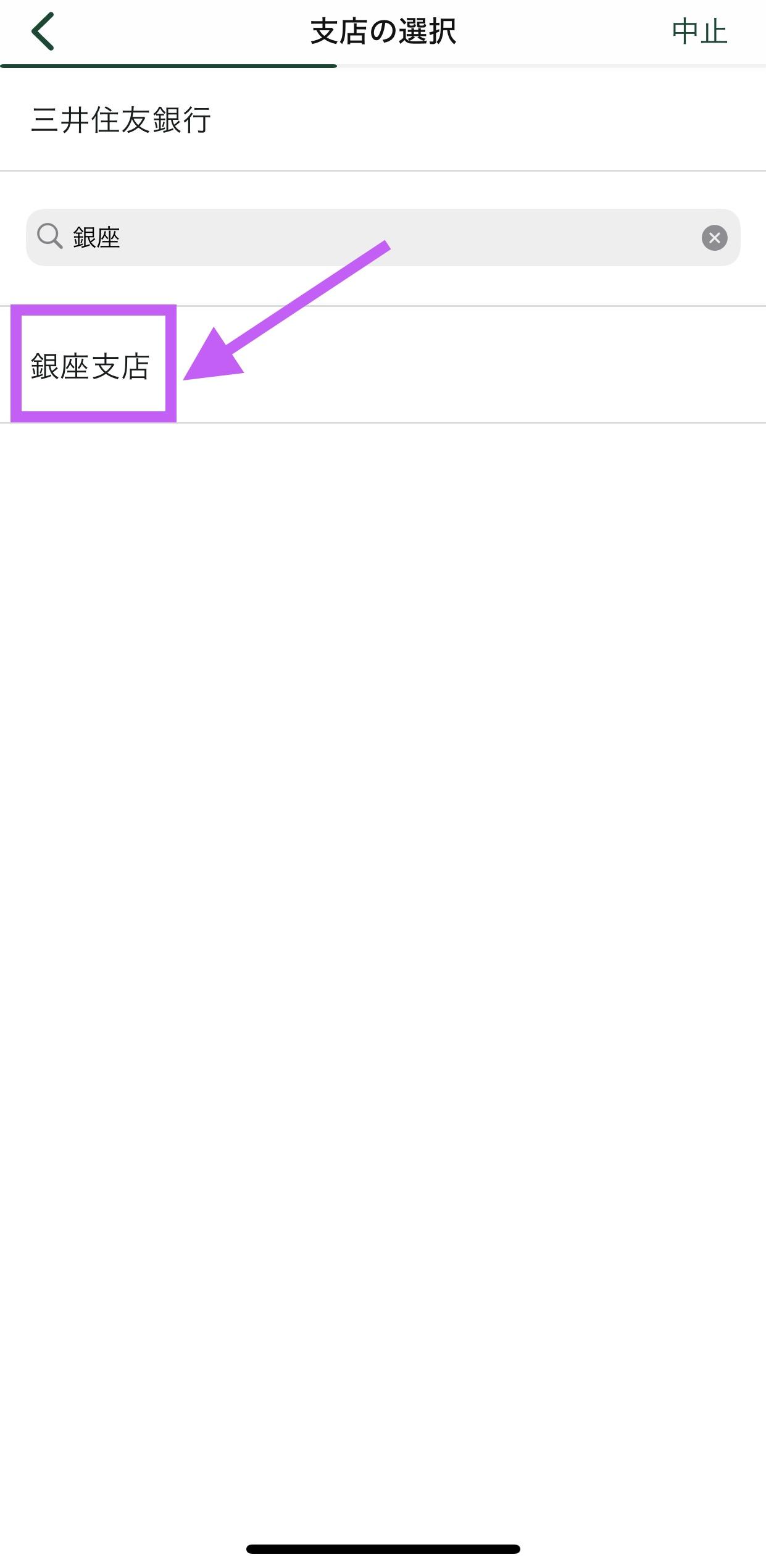

After which you will have to insert the name of the shiten 支店, or branch name.

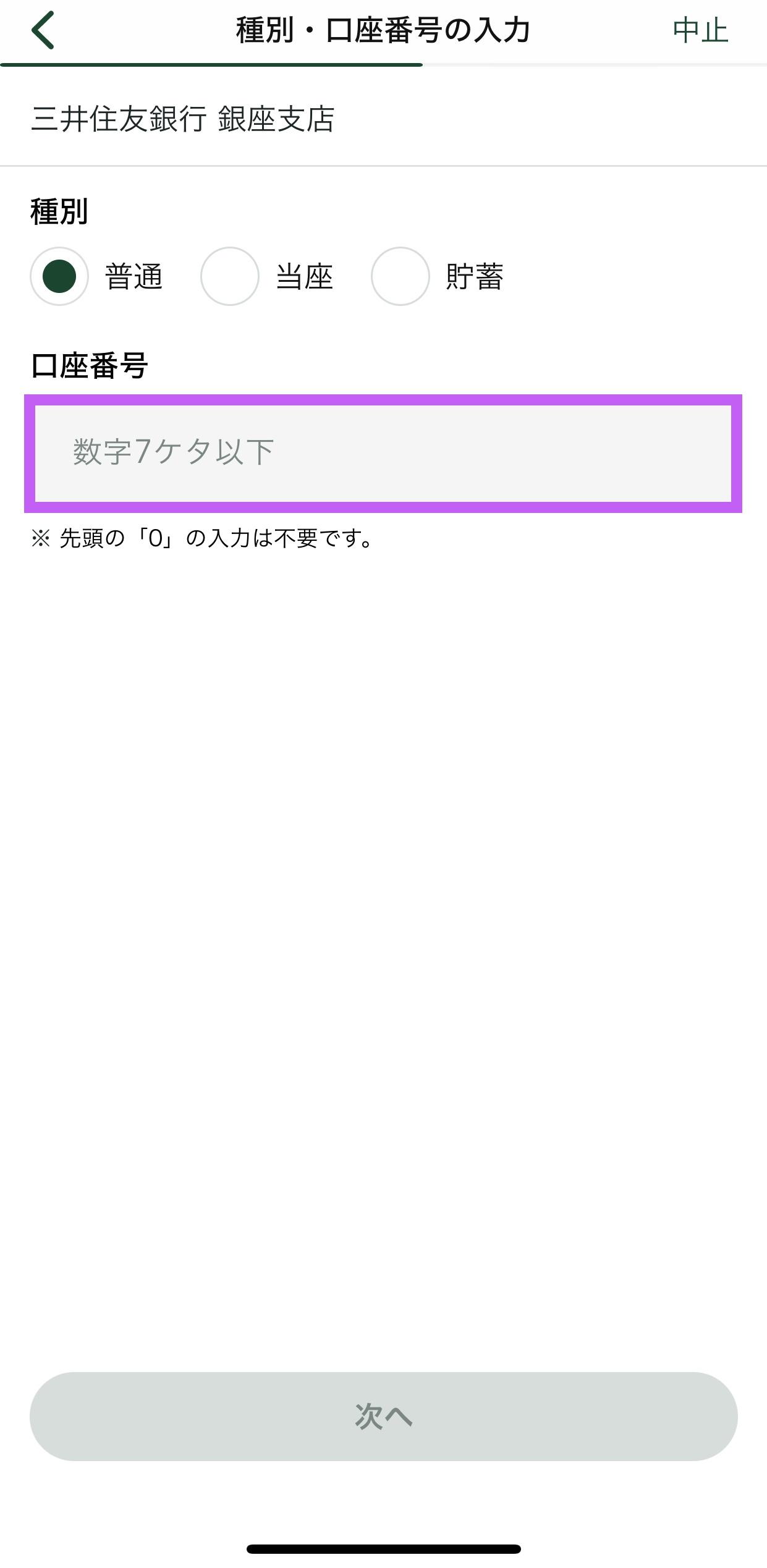

A number of account types will appear on the screen, though in most cases you will be selecting futsū 普通, for a “normal” account, then insert the number associated with the account, 口座番号.

After confirming the amount you wish to send, the transaction should be successfully completed.

Please note that these instructions are from the 三井住友銀行 Sumimoto Mitsu (SMBC) app, and you may encounter slight variations on other banking apps.

If there is ever a time when you are unable to transfer money online but need to send money quickly, there is a low-tech workaround. When signing up for an account, most people are issued a cash card キャッシュカード, otherwise known as a debit card. It is possible to transfer funds using this card at the ATM.

Often, the transfer permission restriction is for online transfers, but will not impact transfers performed at the bank or ATM. The process is very similar to online, but with your debit card. Fortunately, many ATMs have multilingual functionality, at least in English, Chinese, and Korean. By following the same prompts as mentioned earlier – bank name, branch name, account type and lastly, account number – then confirmation of the transfer amount, the ATM will print out a confirmation of the transaction.

Having this information in Japan is vital. Japan is still very much a cash-based society. Large charges, such as upfront move-in costs that one is not expected to pay in cash for, are often required to be paid via bank transfer without any other method of payment accepted. This method of payment is still so prevalent that it is possible to pay online shopping charges through bank transfer rather than on the site.

There may be occasions where you require money transferred to your account as well. In this instance, the information is not difficult to find. Everything you need is already printed on your cash card: not only is there the card’s expiration date, security code and number, but also the bank branch’s number and your account number. If you’re using a personal account, you can safely assume that you have a futsū 普通, or “normal” account type. As always, please do not give away any information other than your bank name, account number, branch name, or account type.

Once your account is set up to send money, the process is rather painless. It’s important to note that banks close at 3pm, and that ATMs for some banks will stop working outside of business hours (though convenience stores will have ATMs that can be used for a fee). Additionally, this article covered domestic transfers – for international transfers, it would be best to consult with your bank directly. Fortunately, banking staff are always well-equipped and happy to provide support no matter what issues may arise.