With the ever increasing problem of mass migration to the big cities, the rural areas of Japan are suffering from depopulation. The Japanese government has implemented a novel idea to help address this issue, called Furosato Nozei or “hometown tax” redirection. Under the system, tax payers can choose to redirect a portion of their city taxes to any participating rural Japanese area of their choosing. This is done by purchasing specific local goods. So what does this mean for you exactly? Essentially you can buy delicious or interesting local goods at a special high price, and then that money is reduced from your tax bill. You ultimately get free stuff!

Can I participate?What kinds of things can I get?

The products available are generally in some way connected to the region you choose to support. This usually means food products, but artistic things and travel vouchers are also available.

Personally, I have participated in the system for three years. My choices have included various honeys from a town in Nagano prefecture, an assortment of preserved meats from Kyushu and lots and lots of apple juice.

Why not take a look yourself on Rakuten? The site is set up so that you can search by product or by region. Be careful not to leave the Furosato Nozei area though! Normal Rakuten products are obviously not eligible. There is another site which is dedicated to the system, called Furosato-Tax.

How do I use the system?

In order to receive a reduction on your tax payments in 2022, you will need to buy your Furosato Nozei products before December 31 2021. This is because the residence tax is based on previous years income. If you are a full time employee of a company, your company probably does your tax for you. This is made easier by the “one-step exemption”. When purchasing your product, there are options to apply for this form.

If you do your own taxes, such as freelancers do, you will need to keep the receipts and apply for a tax return come tax time. Each city ward has slightly different procedures and deadlines, so your best checking with your local ward office regarding such details. The system is by no means new or unknown, so the staff should have the information readily on hand.

One-step exemption

One-step exemption means that you do not have to do extra tax refund work, making the system much easier. The only rule is you must choose less than 5 localities.

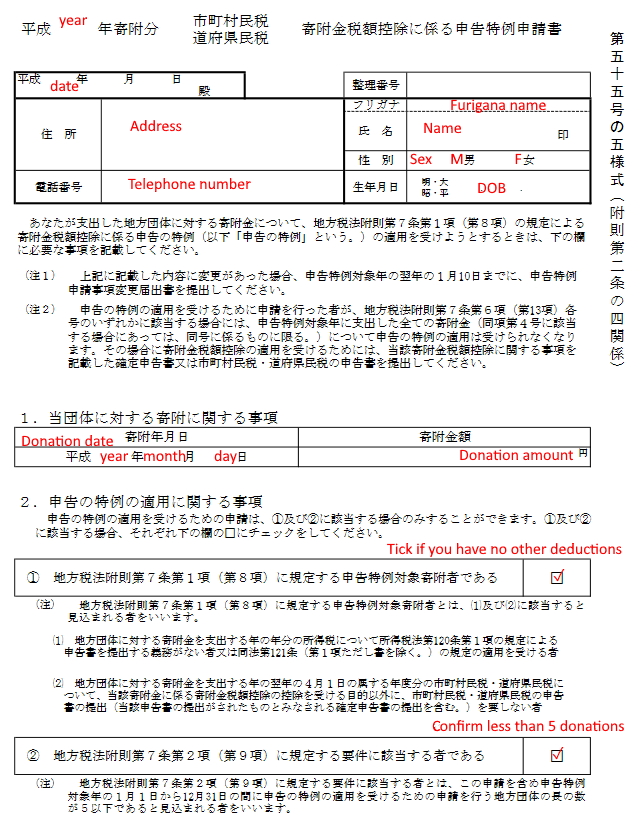

First download the application form from the ministries website. Simply fill in your personal details, the amount of donation and date and confirm some points.

Here is an example for your convenience.

Finally you will need to attach a copy of your My Number card.

How much can I spend?

The deductible amount is relative to the amount of income you pay. Here is a sample of the limit on the amount you should expect. Exact numbers depend on many factors and also where you reside. The system also costs 2000 yen to participate in.

| Yearly Income | Furosato Nozei Limit |

|---|---|

| 300万円 | ¥28,000 |

| 350万円 | ¥34,000 |

| 400万円 | ¥42,000 |

| 450万円 | ¥52,000 |

Persons with children or other deductions such as mortgages will have different amounts. Full a full detailed explanation, the formula can be found on this website (Japanese).

As in most countries in the world, tax is a complicated area. Whilst the information gathered here is believed to be accurate, things can change and specific circumstances can affect a person’s tax situation. It is not possible to guarantee that the rates above apply to you. Personally I try to sit comfortable under the limit I have found for my own situation, in case I have missed something.

I hope this article has helped to you to understand Japanese Hometown Tax scheme, and prompted your interest! It really is a great way to fight population migration to the cities effect on rural communities, and you get a nice treat while you’re at it.